I want to start a business, but where do I start? Is a common question that people have. Whatever type of business you want to start one of the first steps should always be to talk to your Accountant.

Obviously people think about what equipment they may need, they may have an idea of a business plan, but they don’t always realize the value of having a consultation with an accountant before they go ahead and set too many things up.

An important thing that we can help you with at Frederiks Accountants is to decide what entity is best for you to use. Using the right entity can save you money so you really want to get this right from the beginning.

The most common four types are sole trader, partnership, company and trust. There are advantages and disadvantages for each structure so by talking it over with you we can advise you on the best for your circumstances. We can also advise you as to when you should consider changing business structures as sometimes clients don’t come in again for 12 months and their circumstances have completely changed. If you notify us once you reach certain goal posts in your business plan then we can reassess your situation and if changes to the structure are advisable we can put them in play for you.

At Frederiks Accountants we can also help you with business planning which is important for any business at any stage of the business cycle, but especially at the beginning.

We can also discuss your record keeping and find which software package would be the best for you as not everyone is suited to the same platform. At this stage we can also talk about bookkeeping and whether you want to undertake that yourself or use our bookkeeping services. Something which we also offer is that one of our bookkeepers can sit down with you and help set you up so that you can do your own bookkeeping effectively.

The other big question that people have when they start a business is – should I register for GST? This is something we can also discus with you as it’s not always as black and white as saying once you exceed the threshold.

There are lots of things to think about when starting a new business, but seeing an experienced, qualified accountant will save you a lot of headaches and can help save you money by having the right entity from the beginning.

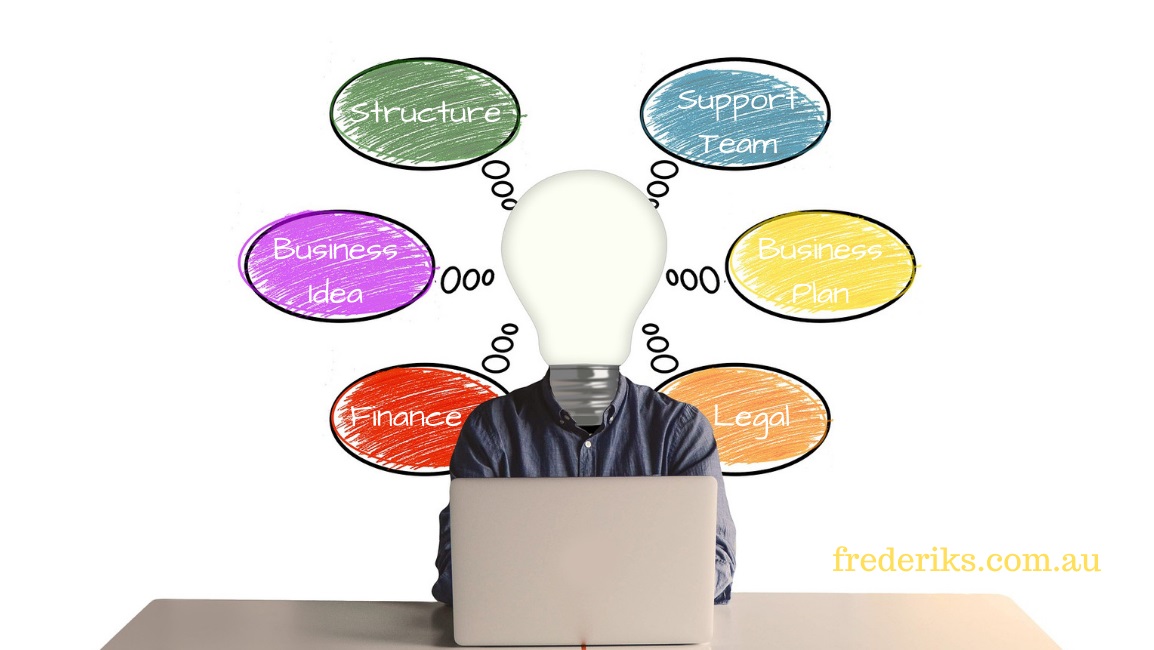

Our Starting a New Business Checklist

- Determine if You Are Ready

- Assess Your Business Idea

- Pick a Structure

- Create a Business Plan

- Check Your Legal Obligations

- Build Your Support Team

- Figuring Out Your Finances

Determine if you are ready – do a self-assessment of your skills and personality, running a business will impact your lifestyle so you have to be prepared for the time and financial commitment involved and also make sure that you have a support network to lean on.

Assess your business idea – you need to undertake a SWOT analysis of your business idea which basically means looking at the strengths, weaknesses, opportunities and threats with an open mind.

Pick a Structure – choose your business structure wisely. As we have mentioned above a qualified accountant is the best person to discuss the pros and cons of the different types of business structures and which would be most appropriate for you.

Create a business plan – many people baulk at the idea of having to do a business plan, but this can save you time and money in the long run and can help you secure funding.

Check your legal obligations – Some of your legal obligations will be affected by the business structure you choose ie tax, licences etc. Registrations and insurances will depend on the type of business you are in, but it is important to ensure you don’t start trading until you’re aware of all the obligations you are under – https://www.employment.gov.au/growing/i-want-start-my-own-business

Build your support team – an accountant is a great start for your support team as they can be trusted and reliable assets to your business. Joining a business association can be a huge help as well and these days they often have groups on LinkedIn or Facebook for members of the relevant association which can be very helpful.

Asking someone to be a mentor or finding another small business owner to act as an accountability partner can be another important member of any support team.

Figuring out your finances – An important part of running a small business is understanding how to set up and manage your finances. You will need to work out your start-up costs and also you’ll need to work out how you will access the finance required to fund your future plans.

Financial forecasts are often required by financial institutions if you’re requiring a business loan and this is something else that Frederiks Accountants can help you with as part of their Business Advisory role.

Other Things to Consider When Starting a New Business

Market your business – many businesses have had a great premise, but have failed to market this idea effectively which is why they have failed. This is something that you really need to plan for whether you undertake this yourself or you outsource to a marketing company.

These posts also make great reading:-

- Setting up a business development plan

- Setting up a business budget

- Setting up a succession plan

- Setting up a risk management plan

- 5 Ways to improve the efficiency of your small business

Also be sure to follow us on Linkedin for more tips, advice and articles with an emphasis on small business.